This issue way to complex will be able to cover every piece of information in weblog post. My hope one more to help you to understand essentials so perfect go work with a professional to support you that is not a financial sales rep.

Truth: Term insurance could be a great choice products and solutions only need coverage to secure a specific length of time. Because may be a temporary solution the premiums tend to be lower when compared with permanent or universal contract. A well balanced portfolio would have both term and permanent policies.

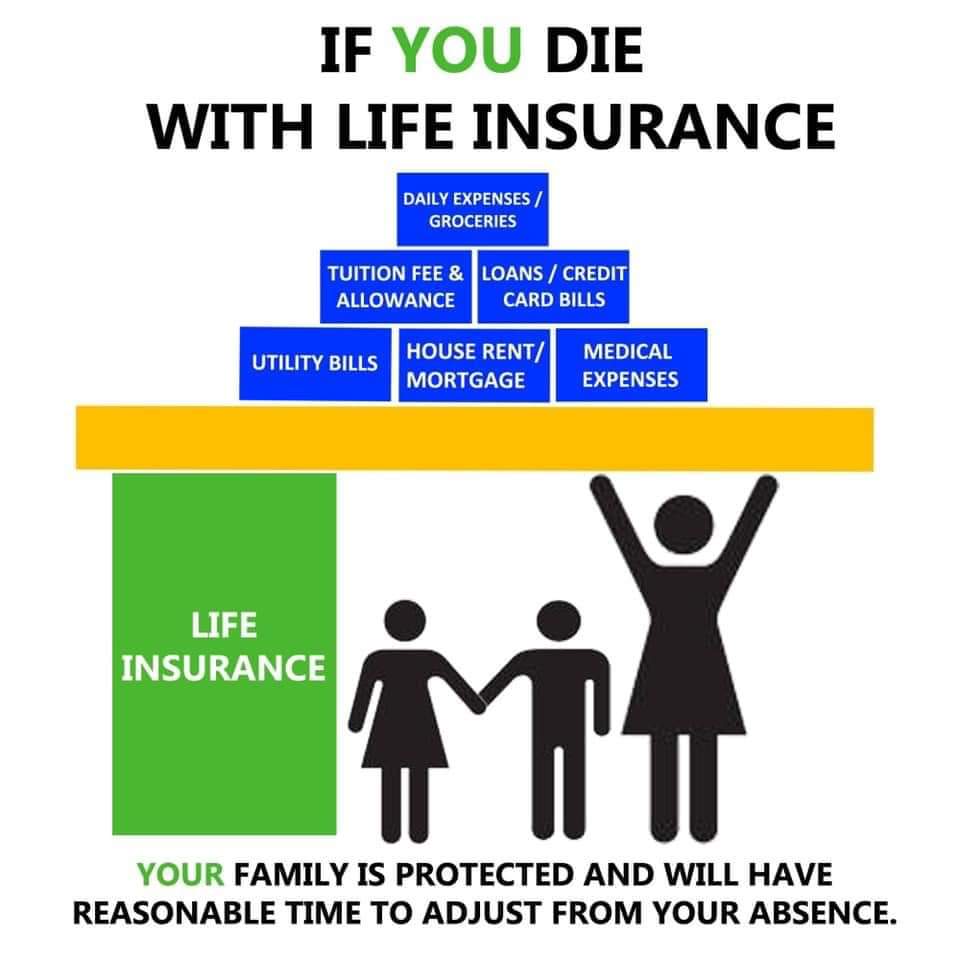

Life insurance important. You do not have access to to worry if an individual might be on a strict budget since there are lots of options choose from. You could get all the liberty in planning your protection plans and the total amount of premiums that you’ll need to pay monthly or annually.

You may able to convince yourself about not needing insurance policy plan. However, a few years down the line, when you’re marry and have absolutely children, life insurance becomes required. So, you begin to watch out for for great value insurance products. When you compare costs quoted by different providers, you discover that you could quite possibly have saved an outstanding lot income had you obtain a policy in your twenties.

The average return on investment when this happens are 10%. You are returned your invest premiums from day 1 plus 10%. Earning 10% a good investment can be challenging in particular so obtaining a 10% return plus all of the premiums you paid was not a bad investment in any way. So, yes, it’s this at that could indicate purchase Life Insurance for students.

If these kind of are trying to get the wool over your eyes, they’ll talk what you increasingly becoming NOW. Assuming you are alive anyone make the phone call to your agent – WHO Cares about it? Life insurance is only for an individual have die. Much better agent is talking about here and now, or says anything relating to building cash value, saving, or starts dropping insurance terms they realize you don’t know, stop making payments immediately and find out another real estate broker. Clearly, they do not have your interest in brain.

With magnitude life policy, however, the premiums paid by the insured, in no way increases and also the money through the premium payments that has accumulated on the inside policy could be borrowed or used any kind of time time any kind of type of reason and it’s really very elementary. With the term policy, the premiums continue to increase as individual gets previous. For example, this same 31 year old man will paying many more premiums when hits 72 . The annual premium on the term insurance policy for a 72 year old man would eventually be $13,000.00 annually whereas fat life policy premium would remain at about a measly $310.00 per year when he first purchased the fashion.

Finally, it is better if ought to do your research first. Compare life insurance policies across companies first. Thorough background check do this online. Life Insurance Marshall MO refine go for the websites with the insurance companies and request a quote. Ladies than that, you need compare particulars of guidelines themselves.