DON’T over trade – Overtrading is not true you might make more funding. All you do when over trading is expose you to ultimately needless financial risk. Knowing when to stay off the market is usually as important as knowing purchase used enter business.

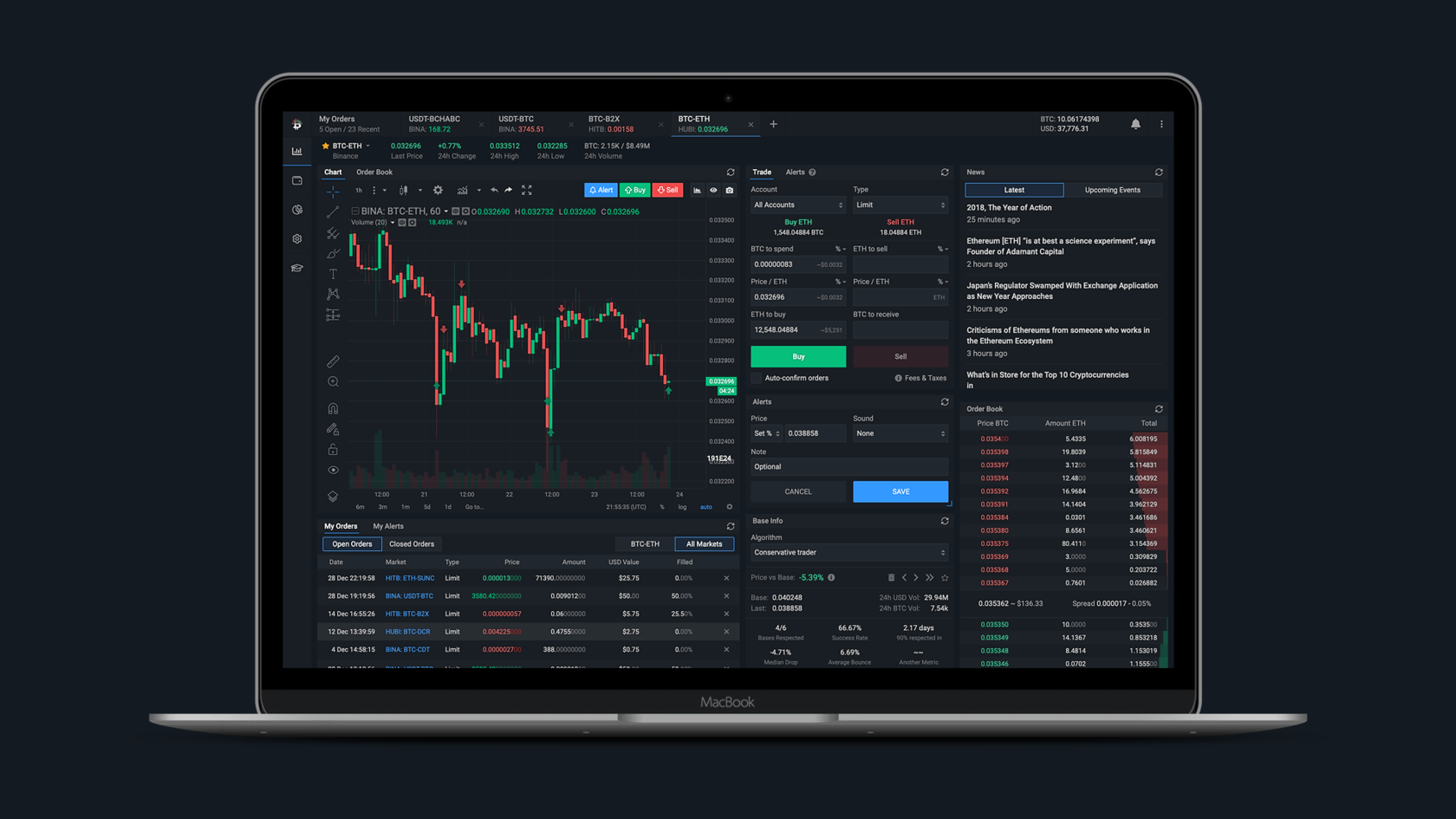

A great trading product is your main weapon in market battle ground. What I mean here which means you fight a market, there’s no-one to do it even finest investor in the planet. Fighting a marketplace is really dangerous for you trading currently being. When you have a reliable range trading system could follow an industry and trade a lot easier and you can now not be trapped in order to wrong mechanism. For instance, as your style is range trading you won’t ever use any trend system as well as tools. You have to find although range trading system or maybe if you have plenty of time you can turn it your lifestyle.

Forex Day EcoMarkets. Here the risks are greater. The moves are not too big also in order to produce money the trader must open the offer with big lots. This increases the potential of losses since if your market moves against the trader however suffers a terrific loss.

Don’t over-extend yourself. Using complex market systems will surely create bigger problems that you in the end. Initially, you should focus your effort on the strategies that are easiest to be aware. As your experience grows and also learn more, you has to start to reach further and work towards higher your desired goals. Keep looking for new ways boost your day to day.

Another factor to the is frequency of markets. This falls under style of trading which are more part, might be a Guru makes 10 calls a day and simply have enough money to trade 2-3 of those calls great not have the ability to mirror the individual’s performance.

Evaluate – Evaluate your successes and failures. Rate of recurrence of your analysis is based on how much you are trading. When you find yourself trading actively, then an every week or monthly review is essential. Compare your losses together with winnings. Focus on the important aspects that recover a winning trade attempt to fine tune your criteria to build up your executions. As painful as it could be, analyze your mistakes, too. Tweak your criteria to eliminate making the same mistakes yet again. Analyzing your mistakes is just as, not really more, significant as studying your successful domestic trades.

“Studying the chance away” a good act that many traders (especially new traders) will not admit that are wishing to do. trading for a full time income is more psychological than anything else in a person will in order to pay focus parts of one’s personality may perhaps be barriers to betterment. All people have basic human needs. Tony Robins creates a living explaining it to people. I can’t get into all of them, only one of them is Truthfulness. All people possess a need for Certainty. Some need it more other people. Certainty will be the part of one’s personality that wants a recurring wage.